◼Timeline

✔ November 11, 2025

Thailand's Subcommittee on Anti-Dumping and Countervailing issued an announcement, making an affirmative final determination on the anti-dumping case concerning H-shaped hot-rolled steel originating from China. It was decided to impose anti-dumping duties based on CIF value for a period of five years on the involved Chinese products, with specific rates as follows: the involved producer/exporter Maanshan Iron & Steel Co., Ltd. at 30.86%, Hebei Jinxi Section Steel Co., Ltd. and other producers/exporters at 54.19%. The Thai HS codes for the involved products are 7216.33.11.000, 7216.33.19.000, and 7216.33.90.000. The announcement took effect the day after its issuance.

✔ November 14, 2024

The Department of Foreign Trade, Ministry of Commerce of Thailand, issued an announcement stating that, in response to an application from domestic Thai enterprises, it initiated an anti-dumping investigation on H-shaped hot-rolled steel originating from China. The Thai HS codes for the involved products are 7216.33.11.000, 7216.33.19.000, and 7216.33.90.000.

◼China's Exports of Involved Products to Thailand Declined After the 2024 Anti-Dumping Initiation

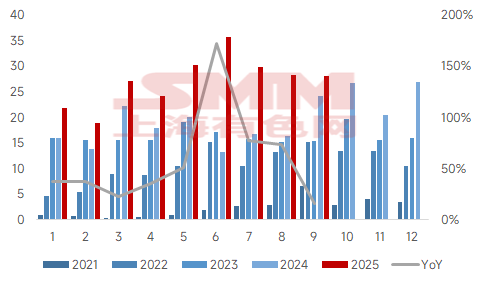

Figure 1 - Total Export Volume of China's Involved Product and YoY Change, 2021-September 2025 (10kt)

According to data from the General Administration of Customs, after 2021, the export volume of the involved product from China grew rapidly, rising from an annual export volume of 280,000 mt to 1.3 million mt in 2022, an increase of 369.12% YoY. Growth continued in the following years. For the period up to September this year, exports reached 2.4445 million mt, up 52.50% YoY (exports for the same period in 2024 were 1.603 million mt). The monthly average was 271,600 mt, and the cumulative export volume to date has already exceeded the total for the entire previous year.

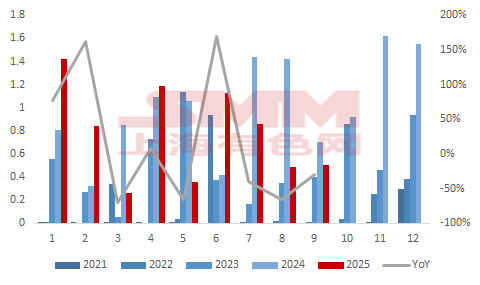

Figure 2 - Total Volume of China's Involved Product Exported to Thailand and YoY Change, 2021-September 2025 (10kt)

The trend in the total volume of the involved product exported from China to Thailand aligns with the overall export trend of the product from China. In 2022, the total volume exported to Thailand was 20,100 mt, an increase of 537.84% YoY. By 2024, the total exports of the involved product to Thailand finally surpassed the 100,000 mt mark. Based on data for the first nine months of this year, China exported 70,500 mt of the involved product to Thailand, down 13.25% YoY (exports for the same period in 2024 were 81,200 mt). In absolute terms, the monthly average for the first nine months was 7,800 mt, accounting for 2.87% of the domestic monthly average export volume of the involved product. The divergence in 2025 between the trend of exports to Thailand and the overall growth trend of China's total exports of the involved product is primarily due to the anti-dumping investigation launched by Thailand on the related product in November 2024.

◼China's Share of Exports to Thailand for the Subject Products Is Relatively Small, and Export Destinations Have Optimized

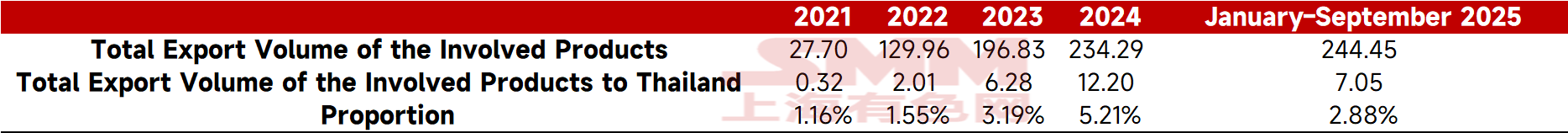

Table 1: Share of Total Exports to Thailand for the Subject Products in China's Total Exports, 2021–September 2025

Regarding the share of total exports of the subject products to Thailand in China's total exports, the overall impact from the anti-dumping measures was significant. Before the initiation of the anti-dumping investigation, this ratio reached 5.21%, but this year it dropped again to 2.88%, with the total volume also falling back below 100,000 mt.

According to General Administration of Customs data, China's total exports of the subject products to Thailand in the first nine months of 2025 amounted to 70,500 mt, accounting for 2.88% of China's total exports of the subject products, indicating a relatively limited overall impact. In an extreme scenario, this could lead to a decrease of 70,500 mt in China's total exports in 2026.

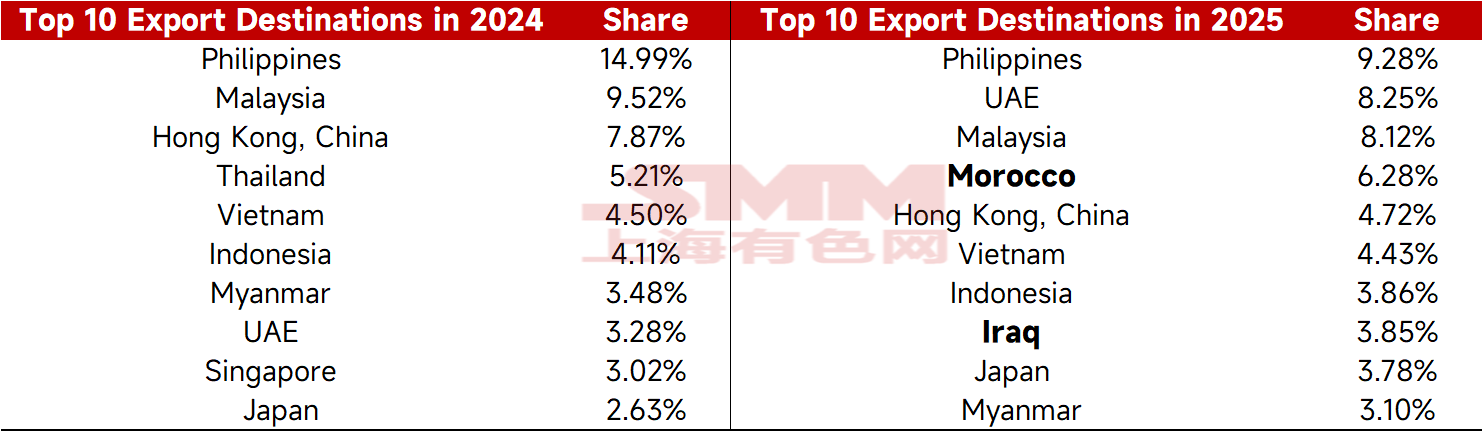

Table 2: Top 10 Export Destinations for the Subject Products and Their Shares, 2024 and 2025

Data shows that the top five export destinations for China's subject products in 2025 were the Philippines, the UAE, Malaysia, Morocco, and Hong Kong, China. Prior to the final anti-dumping ruling in 2024, the top five destinations were the Philippines, Malaysia, Hong Kong, China, Thailand, and Vietnam. By 2025, Thailand had dropped out of the top 10 export destinations for the domestic subject products. This indicates that after Thailand initiated anti-dumping measures against China, domestic exporters actively explored new export channels, with Morocco and Iraq emerging as new destinations. Meanwhile, the distribution of export destinations became more balanced, with the shares of the top three destinations being quite similar.

SMM will continuously track the progress and impact of overseas anti-dumping investigations on steel products. Please stay tuned for related reports. For more information, follow the SMM official account.

*This report is an original work and/or compilation created by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"). SMM lawfully enjoys copyright and is protected by the Copyright Law of the People's Republic of China and other applicable laws and regulations, as well as relevant international treaties. Without written permission, it may not be reproduced, modified, sold, transferred, displayed, translated, compiled, disseminated, or disclosed to third parties in any other form, or licensed for use by third parties. Otherwise, once discovered, SMM will pursue legal action against the infringing party, including but not limited to claiming contractual liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

The content contained in this report, including but not limited to information, articles, data, charts, images, sounds, videos, logos, advertisements, trademarks, trade names, domain names, layout designs, and any or all information, is protected by the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, the Anti-Unfair Competition Law of the People's Republic of China, and other applicable laws and regulations, as well as international treaties concerning copyright, trademark rights, domain name rights, commercial data information rights, and other rights. It is owned or held by SMM and its relevant rights holders. Without written permission, any organization or individual may not reproduce, modify, use, sell, transfer, display, translate, compile, disseminate, or disclose the content to third parties in any other form, or license third parties to use it. Otherwise, once discovered, SMM will pursue legal action against the infringing party, including but not limited to claiming contractual liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

![[SMM Steel] Jindal Steel wins a new iron ore mine in Odisha with ~38 mt reserves](https://imgqn.smm.cn/usercenter/jUyJR20251217171716.jpg)

![Silicon Metal Prices Tested Higher as Market Transactions Remained in Stalemate, While Polysilicon Prices Trended Downward [SMM Silicon Industry Weekly Review]](https://imgqn.smm.cn/usercenter/zLhJl20251217171720.jpg)

![[SMM Daily HRC Trading Volume] Futures Continued to Rise, Spot Trading Continued to Recover](https://imgqn.smm.cn/usercenter/UrrTG20251217171717.jpg)